Your business has outgrown the garage. You’re ready for actual warehouse space. But “Phoenix” is a massive metro area spanning 9,200 square miles across multiple cities and dozens of industrial submarkets.

Where do you even start looking?

Phoenix’s industrial market isn’t one market—it’s a collection of distinct submarkets, each with different building types, price points, vacancy levels, and tenant mixes. The right neighborhood for a semiconductor supplier in Deer Valley makes zero sense for an e-commerce fulfillment operation targeting West Valley consumers.

Here’s how Phoenix’s industrial submarkets actually work and which ones best match different small-business needs.

How Phoenix Industrial Submarkets Are Organized

Phoenix’s industrial real estate market divides into geographic clusters based on highway corridors, city boundaries, and historical development patterns.

Major industrial corridors:

- I-10 West: Goodyear, Buckeye, Tolleson, Avondale (West Valley)

- I-17 North: Deer Valley, North Phoenix

- Airport/Central: Sky Harbor area, South Phoenix

- Loop 202/East Valley: Tempe, Mesa, Chandler, Gilbert

- Scottsdale: Primarily Airpark area

- Loop 303: Outer West Valley growth corridor

Each corridor developed at different times, serves different industries, and offers different building characteristics and pricing.

Small-Bay vs. Big-Box Dominated Submarkets

Before diving into specific neighborhoods, understand which submarkets actually serve small warehouse users:

Small-bay friendly submarkets (buildings under 50,000 SF, often multi-tenant):

- Scottsdale Airpark

- Deer Valley/North Phoenix

- Sky Harbor/Airport area

- Tempe (limited but available)

- Select South Phoenix pockets

- Older Chandler industrial areas

Big-box dominated submarkets (primarily 100,000+ SF distribution):

- West Valley (Goodyear, Buckeye, Avondale)

- Southeast Mesa (gateway area)

- Far North Phoenix/Anthem area

- Outer South Phoenix

If you need under 10,000 SF, focus your search on small-bay friendly submarkets where buildings are actually designed and divided for smaller tenants.

Scottsdale Airpark: Premium Small-Bay Specialist

What it is:

Scottsdale Airpark is Phoenix’s premier small-bay and flex industrial submarket. Buildings typically range from 1,600-50,000 SF total, often subdivided into smaller multi-tenant suites. The area specializes in flex space combining warehouse and office functions.

Characteristics:

- Predominantly older inventory (1980s-built dominates)

- Lower ceiling heights (typically 20 feet)

- Flex office/warehouse combinations are common

- Professional business environment

- Well-maintained properties despite age

- Very tight vacancy—high barrier to entry market

Pricing:

$19-21/SF annually—highest in Phoenix metro, approximately 40-55% premium over market average. The premium reflects location, scarcity, and the professional environment.

Best for:

- Small businesses requiring a client-facing professional image

- Service businesses where clients visit your facility

- Tech companies needing office + light warehouse

- Professional services with product/equipment storage needs

- Owner-users wanting a prestigious business address

Not ideal for:

- Pure warehousing/distribution with no office needs

- Businesses with heavy truck traffic

- Operations requiring 30+ foot ceiling heights

- Budget-conscious operations prioritizing cost over location

- Heavy manufacturing or industrial processes

Access and logistics:

Located in northeast Phoenix/Scottsdale, with access via Loop 101 and Scottsdale Road. Roughly 20-30 minutes to downtown Phoenix, 15-20 minutes to Sky Harbor Airport, well-positioned for East Valley access. Not optimized for the West Valley or the far South Phoenix reach.

Deer Valley/North Phoenix: Semiconductor Hub with Premium Pricing

What it is:

Deer Valley has transformed from a secondary industrial submarket into a premium location driven by TSMC’s $165 billion semiconductor investment and the resulting supplier ecosystem.

Characteristics:

- Newer Class A industrial dominates (32-foot clear height is standard)

- Small to mid-bay focus (25,000-60,000 SF sweet spot, but divisible space exists)

- Heavy power infrastructure supporting manufacturing

- Modern facilities with advanced mechanical systems

- Developers report “we only want to be in two markets—Deer Valley and Tempe”

Pricing:

Approximately $17.60/SF annually—about 30% premium over Phoenix average. Reflects high-quality modern construction and semiconductor-driven demand.

Best for:

- Semiconductor suppliers and manufacturers

- Electronics assembly operations

- Specialized manufacturing requires clean environments

- Businesses needing heavy power capacity

- Companies that want newer construction and modern infrastructure

- Suppliers wanting proximity to TSMC/Intel ecosystems

Not ideal for:

- Budget-conscious operations

- Businesses not benefiting from semiconductor proximity

- Operations are comfortable with older functional buildings

- South Phoenix or West Valley focused distribution

Access and logistics:

I-17 corridor with direct freeway visibility, Loop 101, and Loop 303 access. Phoenix Deer Valley Airport is nearby. Good access to North Phoenix and West Valley, longer drive to East Valley and South Phoenix markets.

Major employers in the area:

TSMC, Sunlit Chemical (semiconductor supplier), Honeywell Aerospace, Amazon, FedEx, Fox Factory Inc., and USAA.

Sky Harbor/Airport Area: Central Phoenix Infill

What it is:

The industrial area surrounding Phoenix Sky Harbor International Airport—the nation’s 11th-busiest airport handling 52.3 million passengers and approximately 400,000 tons of cargo annually—plus adjacent South and Central Phoenix industrial pockets.

Characteristics:

- Mix of Class A and older functional buildings

- Sizes range from 20,000-400,000+ SF

- Clear heights typically 30-36 feet

- Cross-dock capable facilities are common

- Extremely tight vacancy around 5.2%, with some reports showing small-bay availability as low as 1.1%

Pricing:

Around $14-16/SF annually ($1.17/SF monthly), depending on building age and quality. Premium for infill central Phoenix location.

Best for:

- Businesses requiring air cargo proximity

- Distribution operations wanting central metro access

- Companies serving both the East and West Valley equally

- Logistics operations needing I-10, I-17, SR-51, Loop 202 access

- E-commerce fulfillment targeting fast delivery across the metro Phoenix area

- Third-party logistics (3PL) providers

Not ideal for:

- Businesses that rarely ship via air

- Operations that want the newest construction

- Companies focused entirely on the West Valley or the Southeast Valley

- Businesses that are sensitive to aircraft noise

Access and logistics:

Exceptional highway access—I-10, I-17, SR-51, and Loop 202 all converge near the area. Phoenix Sky Harbor provides direct air cargo access. Central location means roughly balanced drive times to all parts of metro Phoenix.

Major tenants:

Amazon, Aramark, Collins Aerospace (Raytheon subsidiary), and numerous 3PL providers.

Tempe: Limited Availability, Infill Premium

What it is:

Tempe’s industrial areas along the I-10 corridor and scattered infill locations represent some of Phoenix’s most constrained industrial submarkets due to limited available land and proximity to Arizona State University and downtown Phoenix.

Characteristics:

- Older inventory (1980s-2000s era) being redeveloped

- Infill locations with very limited new development opportunities

- Small to mid-bay focus due to parcel constraints

- Clear heights 24-32 feet typical

- New shallow-bay development underway (Sight Logistics Park at 356,904 SF, Nexus Commerce Center at 274,000 SF)

Pricing:

Premium market with rents around $15-17/SF annually for quality space, sometimes higher. Limited availability supports premium pricing.

Best for:

- Businesses wanting proximity to ASU (student workers, university partnerships)

- Companies serving affluent East Valley markets

- Operations where downtown Phoenix access matters

- Businesses valuing “Tempe address” for brand perception

- Suppliers serving Tempe/Chandler tech employers

Not ideal for:

- Budget-conscious operations

- Businesses needing larger spaces (50,000+ SF)

- Companies that are comfortable with peripheral locations

- Operations requiring heavy truck traffic through residential areas

Access and logistics:

Loop 202, Loop 101, and I-10 access. Proximity to downtown Phoenix and Chandler. Well-positioned for East Valley reach but less ideal for West Valley.

Chandler: Tech Hub with Diverse Industrial Companies

What it is:

Chandler’s industrial market serves the city’s technology and manufacturing base, including Intel’s massive Ocotillo campus, data centers, and aerospace companies.

Characteristics:

- Mix of manufacturing, R&D, and distribution

- Diverse building sizes (25,000-500,000 SF)

- Modern facilities with heavy power capacity are common

- Flex/industrial combinations for tech companies

- Some older functional space mixed with newer construction

Pricing:

Industrial averaging around $16.92/SF annually—significantly higher than the market due to tech/manufacturing premium.

Best for:

- Technology companies needing office + warehouse/lab

- Manufacturers requiring heavy power or specialized systems

- Companies wanting proximity to the Intel ecosystem

- Data center suppliers and service providers

- Aerospace and defense suppliers

Not ideal for:

- Pure distribution with no specialized requirements

- Budget-focused operations

- Businesses not benefiting from the Chandler tech ecosystem

- Companies needing central Phoenix access

Access and logistics:

Loop 101, Loop 202, and I-10 access. Well-positioned for East Valley, but a longer drive to West Valley or North Phoenix.

Major employers:

Intel (15,000+ employees when new fabs operational), Northrop Grumman, NXP Semiconductors, Magna Steyr.

West Valley (Goodyear, Buckeye, Avondale): Value Pricing, Distribution Focus

What it is:

The West Valley industrial corridor along I-10 and Loop 303 represents Phoenix’s largest concentration of big-box logistics and distribution facilities.

Characteristics:

- Primarily Class A big-box distribution (250,000-1,000,000+ SF)

- Clear heights 30-40 feet standard, many 36+ feet

- Modern cross-dock facilities with 96+ dock doors

- Newer construction dominates (2015-present)

- 81.5% of Phoenix construction concentrated here

- Some smaller spaces exist but not the primary market focus

Pricing:

$10.56-11.76/SF annually ($0.88-$0.98/SF monthly)—most affordable in metro. Northwest cluster saw 15.3% year-over-year rent increase, but still below the market average.

Best for:

- Large-scale distribution operations

- E-commerce fulfillment serving West Valley/Arizona/California

- Businesses prioritizing cost over central location

- Operations with heavy truck traffic

- Companies needing significant outdoor storage or trailer parking

Not ideal for:

- Small businesses needing under 5,000 SF (limited options)

- Companies requiring frequent East Valley or Central Phoenix access

- Businesses where employees commute from the East Valley

- Operations where clients visit the facility (unless clients are West Valley-based)

Access and logistics:

I-10 corridor to California and Texas, Loop 303 beltway, future SR-30, MC-85 trucking route to Mexico. Phoenix-Goodyear Airport. Excellent for regional distribution, but long drive times to the East Valley.

Major tenants:

Amazon (3.5 million SF across three facilities), CEVA Logistics (1.3M SF), Walmart (1.28M SF), Ross Stores (1.6M SF), REI, Home Depot, Target, Costco.

South Phoenix: Mixed Inventory with Price Diversity

What it is:

South Phoenix industrial areas comprise a patchwork of older and newer facilities with diverse quality levels and pricing.

Characteristics:

- Wide range of building ages (1970s-2020s)

- Mix of small-bay and mid-sized buildings

- Quality varies significantly from property to property

- Some areas are actively redeveloping, others are aging in place

- Clear heights typically 20-28 feet

Pricing:

$13-18/SF annually, depending on building age, quality, and specific micro-location. Among the most diverse pricing in the metro area.

Best for:

- Budget-conscious operations willing to evaluate multiple properties

- Businesses that are comfortable with older functional buildings

- Distribution serving the South Phoenix/Tucson corridor

- Companies wanting I-10 access without West Valley drive times

- Operations where building appearance isn’t critical

Not ideal for:

- Businesses requiring the newest construction

- Companies wanting uniform neighborhood quality

- Operations where clients visit and first impressions matter

- Businesses uncomfortable evaluating wide range of building conditions

Access and logistics:

I-10 corridor access, Loop 202 South Mountain Freeway. Good positioning for Tucson and Southern Arizona reach.

Neighborhood Selection Framework for Small Business Warehouse Space in Phoenix

Use this decision framework to identify your best-fit submarkets:

Step 1: Define your actual operational needs

- Do clients ever visit your facility? (Yes = consider Scottsdale Airpark, Deer Valley, Tempe)

- Do you make frequent deliveries/service calls? (Yes = prioritize highway access matching your service area)

- Do you ship via air cargo? (Yes = Sky Harbor area)

- Do you need heavy power or specialized infrastructure? (Yes = Deer Valley, Chandler)

- Is your business tied to specific industry ecosystems? (Semiconductor = Deer Valley; Tech = Chandler)

Step 2: Establish your realistic budget

- Premium markets ($17-21/SF): Scottsdale Airpark, Deer Valley, parts of Chandler

- Mid-tier markets ($14-17/SF): Sky Harbor area, Tempe, South Phoenix (better buildings)

- Value markets ($11-14/SF): West Valley, South Phoenix (functional older buildings)

Step 3: Map where your employees, customers, and suppliers are located

- Employees commute from East Valley = avoid West Valley

- Customers concentrated in North Phoenix = Deer Valley makes sense

- Suppliers primarily West Valley = consider West Valley despite employee commutes

Step 4: Assess building type needs

- Need 30+ foot ceilings for racking = West Valley, Deer Valley

- Comfortable with 20-24 feet = Scottsdale Airpark, older South Phoenix

- Need office + warehouse = Scottsdale Airpark, Chandler flex, Deer Valley

- Pure warehouse, no office = West Valley, South Phoenix, Sky Harbor area

Step 5: Factor in growth plans

- Plan to scale from 1,000 SF to 5,000 SF in 2 years = choose submarkets with multi-tenant buildings offering expansion

- Uncertain space needs = co-warehousing in any submarket, offering flexibility

- Long-term stability = traditional lease in submarkets matching long-term operational needs

The Hidden Cost of Wrong Location Choice

Picking the wrong submarket costs more than just rent—it compounds through wasted time, employee turnover, and operational inefficiency.

Employee commute impact:

If you lease in Goodyear but your three employees all live in Tempe, they face 60-90 minute commutes each way. Multiply three employees × 2 hours daily × $25/hour average loaded cost = $150/day = $3,000/month in dead commute time. That’s $36,000 annually in employee time spent driving instead of working.

Delivery efficiency:

A service business making five daily service calls across Phoenix from a West Valley warehouse spends 30-45 extra minutes per call day (versus a central location) reaching East Valley clients. That’s 2.5-3.75 hours daily wasted in unnecessary drive time = $200-300 daily = $50,000-75,000 annually in lost productivity.

Client perception:

For businesses where clients visit, location matters. A professional service company operating from an aging South Phoenix warehouse versus Scottsdale Airpark creates different client impressions that can impact deal closure rates.

Shipping costs:

Distribution operations centered in far West Valley incur higher per-package costs reaching East Valley consumers versus centrally-located facilities—costs that compound over thousands of shipments annually.

Run your own numbers based on your specific operations. Sometimes paying 30% more rent for the right location saves 50% in operational costs and wasted time.

Submarket Vacancy Snapshot: Where Space Is Tightest in Phoenix

Understanding current vacancy helps set realistic expectations:

Extremely tight (<3% vacancy):

- Scottsdale Airpark

- Sky Harbor small-bay

Tight (3-7% vacancy):

- Deer Valley/North Phoenix

- Tempe infill

- South Phoenix (select pockets)

Moderate (7-12% vacancy):

- Chandler (varies by building type)

- South Phoenix overall

Elevated (12%+ vacancy):

- West Valley big-box (15%+)

- Outer submarkets

In extremely tight and tight markets, expect to pay asking rent with minimal negotiating leverage, faster decision timelines (quality spaces lease in weeks), and potential waitlists for preferred buildings.

Making the Location Decision for Warehouse Space in Phoenix

Your ideal Phoenix submarket balances:

- Rent you can afford without compromising operations

- Access to your customers, employees, and suppliers that minimizes wasted drive time

- Building infrastructure that matches your actual operational needs

- Neighborhood trajectory that aligns with your business plans

- Availability realistic to your timeline and space requirements

No submarket is objectively “best”—only best for your specific situation. A semiconductor supplier thrives in Deer Valley but would waste money there if they’re actually running e-commerce fulfillment serving West Valley consumers.

Start with your operational reality, then find the submarkets that match—not the other way around.

FAQ

Which Phoenix neighborhood has the most small warehouse availability?

Scottsdale Airpark specializes in small-bay and flex space with the highest concentration of buildings sized 1,600-50,000 SF, though availability is tight due to limited inventory and high demand. Sky Harbor/Airport area and South Phoenix offer more total small-bay inventory across diverse building types and price points. West Valley has minimal small-bay options—that submarket focuses on big-box distribution (100,000+ SF). For practical availability, focus searches on Scottsdale Airpark, Sky Harbor area, Deer Valley, and South Phoenix.

What’s the most affordable Phoenix area for small warehouse space?

West Valley (Goodyear, Buckeye, Avondale) offers the lowest rents at $10.56-11.76/SF annually, but small-bay options are limited in this big-box dominated area. South Phoenix provides the best combination of affordability and small-bay availability, with functional older buildings ranging $13-15/SF annually. Budget-conscious small businesses should focus on South Phoenix, avoiding premium submarkets like Scottsdale Airpark ($19-21/SF), Deer Valley ($17.60/SF), and Chandler ($16.92/SF).

Where should e-commerce businesses look for Phoenix warehouse space?

E-commerce operations should prioritize locations matching their customer base geography. For metro-wide coverage, Sky Harbor/Airport area ($14-16/SF) offers central positioning with balanced drive times. West Valley locations work well serving Arizona/California/Western US markets via I-10 corridor. East Valley (Tempe, Chandler, Mesa) suits businesses focused on affluent East Valley consumers. Consider Phoenix Sky Harbor’s air cargo capabilities if shipping via air freight.

Is Scottsdale Airpark worth the premium pricing?

Scottsdale Airpark’s $19-21/SF pricing (40-55% above market average) makes sense for specific businesses: professional services where clients visit your facility, companies needing office + warehouse combinations, tech businesses wanting prestigious addresses, or owner-users prioritizing location over cost. It doesn’t make sense for pure warehousing/distribution, heavy manufacturing, operations with significant truck traffic, or budget-conscious businesses comfortable with functional older buildings in less prestigious locations.

Which areas are best for semiconductor and manufacturing businesses?

Deer Valley/North Phoenix dominates semiconductor supplier demand due to proximity to TSMC’s $165 billion campus and modern facilities with heavy power infrastructure ($17.60/SF annually). Chandler serves Intel’s ecosystem with industrial facilities designed for tech and manufacturing ($16.92/SF). Both submarkets offer newer construction, specialized infrastructure, and manufacturer-focused amenities. South Phoenix and the West Valley offer lower-cost alternatives for manufacturers not requiring semiconductor proximity or newest construction.

How much does location impact Phoenix warehouse rent?

Phoenix warehouse rents vary 90-100% between premium and value submarkets. Scottsdale Airpark ($19-21/SF annually) commands nearly double West Valley rates ($10.56-11.76/SF). Deer Valley ($17.60/SF) runs 65% higher than West Valley. Even within submarkets, specific micro-locations create 15-25% pricing variations. For a 2,000 SF unit, the difference between a $11/SF West Valley space ($22,000 annually) and a $20/SF Scottsdale Airpark unit ($40,000 annually) equals $18,000/year or $1,500/month.

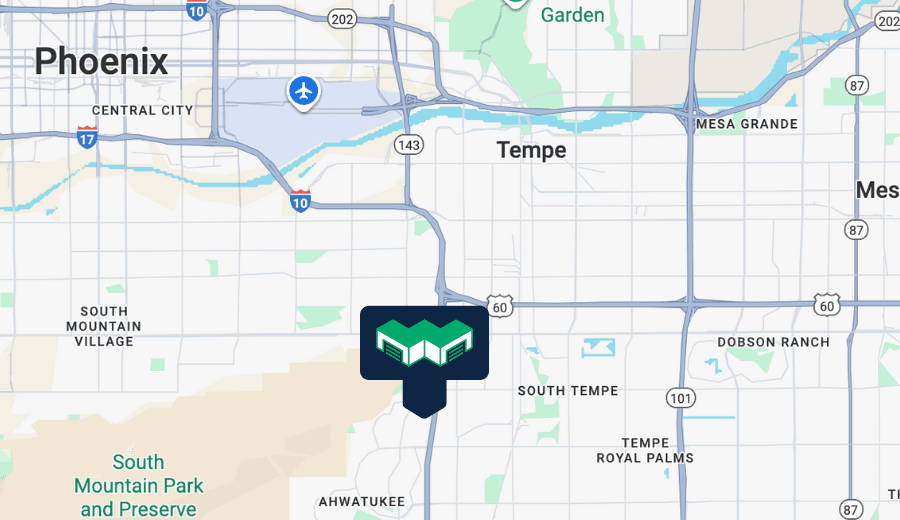

Looking for Phoenix warehouse space in a convenient South Tempe location?

WareSpace Phoenix South Tempe offers small warehouse units from 200-2,000 SF just minutes from I-10, with easy access to both East and West Valley markets. Climate-controlled space, loading docks, and flexible terms.

►

Explore 3D Space

►

Explore 3D Space